Washington PostNew oil pipeline boosts Iraqi Kurdistan, the region made of three northern provinces

Erbil, the regional capital of Iraqi Kurdistan, has all the trappings of an oil boomtown. It bristles with construction cranes. Land Cruisers and Range Rovers with tinted windows ply the busy streets. Oil workers and briefcase-bearing foreigners crowd into the Divan Erbil Hotel’s piano bar.

At the foot of the 8,000-year-old Citadel — which claims to be the oldest continuously inhabited town in the world — currency traders in the central market swap dollars, euros and Turkish liras for Iraqi dinars. Shoppers flock to Erbil’s Family Mall, which features stores such as French hypermarket Carrefour and Spanish clothing chain Mango.

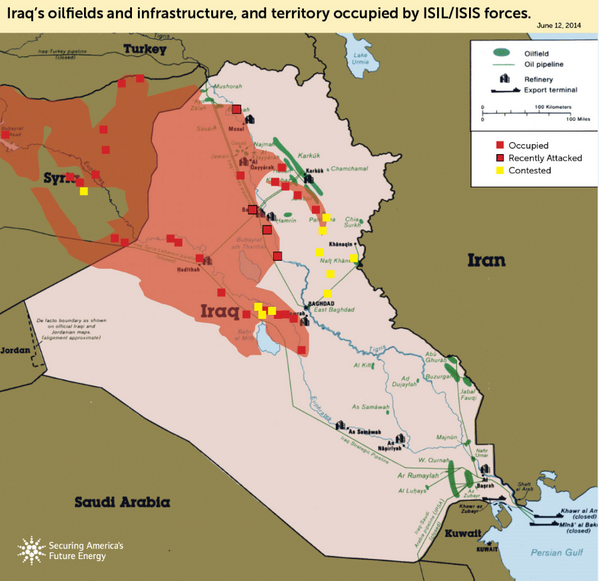

With the opening of a new oil pipeline, the boom is getting a boost. Crude that used to be transported by truck across the rugged, mountainous terrain of the three northern provinces known as Iraqi Kurdistan began flowing in stages through the pipeline in January.

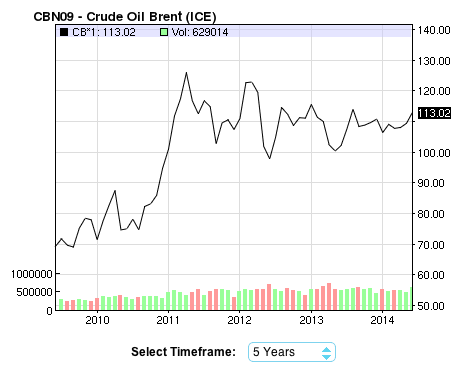

The conduit, built by the Kurdistan Regional Government, or KRG, runs about 250 miles from Khurmala, southwest of Erbil, to the Turkish border, where it connects with an existing link to the Mediterranean port of Ceyhan. Oil that sells for about $70 a barrel domestically could fetch $100 or so in world markets.

The KRG said in October that the average output would be 400,000 barrels a day in 2014 and could jump to 1 million barrels by 2015 and twice that much by 2019. For 5.2 million Kurds in an area roughly the size of Switzerland, the influx of foreign investment and rising oil-related income promises an improving standard of living as the rest of the country remains mired in sectarian violence.

Since the KRG began selling oil contracts to foreign investors in 2007, per capita gross domestic product in Kurdistan has soared; it hit $5,600 in 2012, up from $800 10 years ago. The boom has also benefited oil exploration companies, especially those that placed early bets.

Risk and reward

Beginning with the 1980-88 Iran-Iraq War, the development of natural resources across all of Iraq, including Iraqi Kurdistan in the north, was virtually on hold for more than two decades. That’s because a series of full-blown conflicts and internecine clashes preoccupied first Saddam Hussein and then the fractious leadership in Baghdad that followed his ouster by U.S. and U.K. coalition forces in 2003.

Since then, almost daily clashes in the south have pitted the Shiite majority that dominates Iraq politically against the Sunni minority that held sway under Hussein. In the north, the population is overwhelmingly Sunni and relatively free of sectarian strife. In fact sheets for foreign investors, the KRG says no coalition soldiers have been killed and no foreigners kidnapped in Iraqi Kurdistan.

Todd Kozel, chief executive officer of Bermuda-based Gulf Keystone Petroleum, came to Iraqi Kurdistan three years after the 2003 invasion.

“If you were an oilman in 2006, with oil in your blood, you just had to be here,” he says, sipping Johnnie Walker Black Label at the Divan.

Kozel, 47, says he saw opportunity in a land where high risk would be highly rewarded. And it was. Since Gulf Keystone discovered oil at Iraqi Kurdistan’s Shaikan field in 2009, its market value has grown to about $1.66 billion from about $80 million.

The first foreign exploration firm to come to Kurdistan — in 2004 — was Oslo-based DNO International. Chairman Bijan Mossavar-Rahmani says DNO plans to increase output from its Tawke field to about 200,000 barrels a day this year from about 125,000 in 2013, showing how companies will hike production when their oil can be sold at higher world-market prices.

Tony Hayward came to Kurdistan after the 2010 Deepwater Horizon oil rig explosion in the Gulf of Mexico cost him his job as BP’s chief executive — in part because of a string of public-relations fiascoes that included his saying “I would like my life back” to a group of reporters while touring an oil-slicked beach in Louisiana.

In 2011, Hayward joined forces with British financier Nathaniel Rothschild to acquire a Turkish firm already operating in Kurdistan. The firm, renamed Genel Energy, says it’s poised to raise production at Taq Taq and other fields to 70,000 barrels a day this year from 44,000 in 2013. On May 8, Hayward was named chairman of Glencore Xstratam, a mining company that is also one of the world’s biggest crude traders.

Since 2011, four big oil companies — Chevron, Exxon Mobil, Hess and Total — have followed 30 or so smaller players into Iraqi Kurdistan and signed exploration deals. Hayward, whose career straddles oil majors and minors, says the pattern is a familiar one.

“There are lots of entrants early on, the real frontier types,” Hayward says in his London office. “Then the big guys arrive, and there’s consolidation. If you’re a little guy, you have to get there early.”

Transforming Iraq

The oil boom is transforming a part of Iraq that ethnic Kurds throughout the South Caucasus and Middle East consider their homeland. Unlike Kurdish enclaves in Iran, Turkey, Syria and Armenia, Iraqi Kurdistan is self-ruled, having gained autonomous status in a 1970 agreement with the central government in Baghdad.

Though it defers to the government on most external affairs such as treaties and membership in international organizations, the KRG has its own parliament, issues its own visas and has its own army, the Peshmerga — meaning “those who confront death” in Kurdish.

Oil is also changing relations between Iraqi Kurdistan and the central government. They’ve been tense for decades — never more so than in the closing days of the war with Iran, when Hussein’s forces launched a chemical attack on the Kurdish city of Halabja, killing as many as 5,000 people in retaliation for collusion between Kurdish and Iranian fighters.

In 1991, at the end of the Gulf War, the U.S. and its allies established a safe haven in Iraqi Kurdistan enforced by a no-fly zone. While the no-fly zone effectively created a buffer between the Kurds and their masters in Baghdad, accelerating economic development in the north, the north-south dispute over oil carried on.

Iraq’s State Oil Marketing Organization maintains that it has exclusive rights to the sale of Iraqi Kurdistan’s oil, whether it flows through the new pipeline or through pipelines outside of Iraqi Kurdistan.

In December, the KRG agreed to work with the central government in Baghdad in determining how to distribute revenue from Kurdistan oil exports, though a lot of questions remain unanswered, according to Sanford C. Bernstein financial research firm.

“The resource base is too big for a solution not to be found,” the Beveridge analysts wrote.

The new pipeline, fully in KRG territory, should make it easier for Kurdistan to overcome central government resistance and get its oil to market, says Gareth Stansfield, a senior associate at the Royal United Services Institute, a London-based research organization.

“If the Kurds are able to pump the amounts of oil they’re promising, then this is a fundamental geopolitical game changer,” Stansfield says. “It gives the Kurds economic independence from Baghdad.”

Many Iraqi Kurds want more than that: Almost 60 percent of those surveyed supported statehood in a 2012 poll by the Kurdistan Institute for Political Issues.

North vs. south

Iraq ranks fifth in the world in proven oil reserves — 150 billion barrels, according to the BP Statistical Review of World Energy 2013. The KRG says Kurdistan alone — comprising less than a 10th of Iraqi territory — holds 45 billion barrels. If the autonomous region were a country, its reserves would rank it 10th in the world, after Libya, according to BP.

While oil production has soared in the north, slower output in the war-torn south has kept Iraq-wide production low: Only in recent months has output reached 1979 levels of 3.62 million barrels a day, according to OPEC.

The hassles of dealing with Prime Minister Nouri al-Maliki’s Baghdad government compound sluggish production in the south, says Paolo Scaroni, CEO of Eni, Italy’s biggest oil company. Eni is one of several large companies, including BP and Royal Dutch Shell, operating in the south.

“We’re suffering from a lot of complex bureaucracy,” Scaroni says.

Eni had planned to invest $7 billion this year in developing its oil business in the south; it will end up spending only $3 billion, he says.

In the north, it’s a different story. Genel has been shipping crude to Turkey by truck, with 700 tankers rolling out of its Taq Taq field every day. With the new pipeline expected to be fully up and running later this year, the company says it’s poised to take advantage of the new transportation capability by increasing production.

The KRG’s Ministry of Natural Resources says its goal is to transport 300,000 barrels a day by the end of the year via the pipeline, shifting a sizable portion of exports away from tanker transport, not to mention pipelines controlled by the government in Baghdad.

Hayward, who visited southern Iraq as the head of BP from 2007 to 2010, says he was impressed by the contrast between Erbil and Baghdad when he first traveled to the north in 2011.

“The thing that really struck me was the amount of development that was taking place,” Hayward says of Erbil. “It felt safe, secure and prosperous.”

Oil is also helping to change the relationship between Turkey and Iraqi Kurdistan.

Beginning in the 1980s, the Kurdistan Workers’ Party, known by its Kurdish acronym, PKK, began an armed struggle against the Turkish government, seeking to establish an independent Kurdish nation in and around northern Iraq — including the Kurdish-dominated area of eastern Turkey. Turkey was wary of Iraqi Kurdistan as a staging area for PKK paramilitaries.

In 2003, Turkey, though a NATO member, refused to allow U.S. troops to invade Iraq from the north through Turkish territory partly out of concern the invasion would, in toppling the Hussein regime that had oppressed the Kurds, promote Kurdish independence movements. The PKK and the Turkish government agreed to a cease-fire in March 2013, easing tensions.

“Turkey’s been a big help,” Gulf Keystone’s Kozel says. “All our drilling rigs come through there.”

Iraqi Kurds — fearing their enemies, distrustful of neighboring governments, victims of Hussein’s genocidal attacks — are used to doing whatever they can to determine their destiny, Hayward says.

“It’s clear as the Kurds get more and more production and infrastructure, they’re just going to do their own thing,” he says. “As they like to say, ‘We have no friends but the mountains.’ ”http://www.washingtonpost.com/business/ ... story.html